Considering Filing Chapter 11 Bankruptcy and Looking for the Right SOUTH FLORIDA LAWYER to Help You Decide What to Do and Potentially Help You File?

About Chapter 11 Bankruptcy

- Used primarily for businesses (small or large); however, it is also used for individuals with large debts and assets too great for the strict limitations of a Chapter 13

- As an alternative to a Chapter 7, which would require a business to liquidate, under a Chapter 11, your business is allowed to keep many of its assets

- Does not eliminate your debt, but restructures your debt and monthly bills into a payment that you can manage, that way your business can keep its doors open and remain operating

- Used if your income is too high and do not meet the requirements to file a Chapter 7

- Used when your secured debt is beyond the limitations of a Chapter 13

- Provides the benefit of an "automatic stay" as soon as it's filed which stops all collection activity throughout the bankruptcy process

- Not required to complete the financial management course that is required for a discharge under both Chapter 7 and 13 bankruptcies

- The most complex of all bankruptcies, therefore strong consideration should be made to hire an experienced bankruptcy firm

Why Choose Van Horn Law Group in South Florida

- Free, no obligation case evaluation

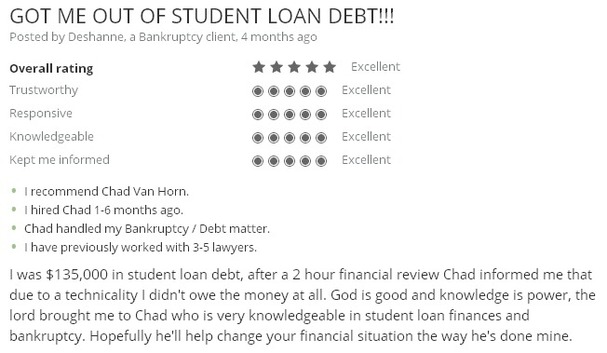

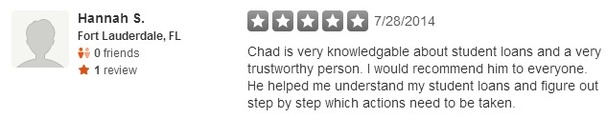

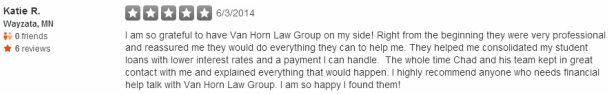

- Highly rated & reviewed on Google

- We take the time to review all aspects of your financial situation

- If bankruptcy is not the right option for you, we actually let you know

- We don't talk down to our clients

- We don't hide behind legal jargon

- We don't pass important work off to paralegals or unqualified support staff

- We often take cases other attorneys are unwilling or unable to handle

- We often take cases regardless of how complex your case may be

- AV Preeminent® Rated from Martindale-Hubbell®

- We'll be there with you every step of the way

- Flexible appointment availability

- We handle personal and business bankruptcy cases

- We believe being genuinely caring and compassionate matters!

Ask a Question, Describe Your Situation or Request a Free Consultation

We respect your privacy

The information you provide will be used to answer your question or to schedule a consultation if requested.

Benefits of Filing Bankruptcy With a Lawyer in South Florida

- Bankruptcy can also act as a reset button for your credit

- The removal of outstanding debt can be a huge boost for your credit score

- Once done, you can begin rebuilding your credit immediately

- Filing for bankruptcy can be the first step to stabilizing your life

- There is no reason to be ashamed to take this measure as it is meant to assist those who have fallen on hard times

Questions Or Ready For a Free Consultation?

Call Us At (954) 800-6660, or Chat Online, or Complete The Form Above

Click to Call (954) 800-6660

STILL HAVE QUESTIONS?

-

How do I know if I qualify for bankruptcy?

Florida is the easiest state to qualify and file for bankruptcy because there are no minimum or maximum income requirements.

-

Do I need an attorney to file for bankruptcy?

While you are entitled to file for bankruptcy without an attorney, the process is quite complex and errors may lead to delays or a denial of your petition.

-

Will my credit be destroyed if I file for bankruptcy?

No. Once the overdue debt is discharged (Chapter 7) or renegotiated and paid down, your credit will start to improve almost immediately.

Client Reviews

Questions or ready for a free consultation?

Talk to our South Florida attorneys. Why put it off? Get answers today.

Over 100 Awards & Recognitions

-

6500+Chapter 7

Bankruptcy Filings -

280+Chapter 11

Bankruptcy Filings -

2800+Chapter 13

Bankruptcy Filings -

9800+Total

Bankruptcy Matters -

99%Discharge Rate

ABOUT OUR ZERO DOWN BANKRUPTCY OPTION

While many people opt to pay for fees at once or on a retainer basis, some prefer to utilize our $0 Down payment option. Here's how it works: After you sign an engagement for services agreement with our firm, generally speaking, the court filing fees and costs will be paid up front. These can be waived in certain circumstances. You do not pay anything initially for our bankruptcy legal fees. We work out a payment plan with you, where you are aware of the fees in advance for our services. You'll pay on a monthly basis over time until our fee is paid. Some clients find this helps to allow them to meet all their obligations while the bankruptcy process proceeds. If you have further questions about our services or this option, please don't hesitate to contact our office.

Client Fee Payment Policy